Modules

Lighthouse is a fully integrated accounting application that includes the following modules.

• Billing and Accounts Receivable

Accounts Payable

The Accounts Payable system is the primary tool for handling firm expenses, and as with all other accounting features, it is fully integrated. Once information is posted through the Payables routine, it becomes available to the entire system.

Lending flexibility to the Payables system, Lighthouse allows the selection of all invoices for payment, the selection of only those invoices due by a specified date, or specified individual invoices. Lighthouse also allows invoices to be paid on a partial basis. While Lighthouse offers Automatic Cheque printing, thus simplifying the invoice payment process, the Manual Cheques Entry routine enables the user to enter Cheques that have been processed manually.

Supplier information is easily accessed and maintained. The Supplier Inquiry allows management to view details about both outstanding and paid invoices at any given time. Invoices and payables adjustments can be easily made, and all transactions are tracked by audit trails.

Features

• Supplier Inquiry

• AP Trial Balance

• Cash Requirements Report

• Released Amounts Listing

• Credit Adjustments/Change Invoice Supplier

• Tax Credit Report

• Tax Payables Report

Bank Reconciliation

The Bank Reconciliation system allows the Firm to effectively track Cheque and Deposit transactions, ensuring up to date and accurate Bank Account balances and information. The Bank Reconciliation system also allows the Firm to easily identify and correct any discrepancies between Bank Statements and in-house accounting statements.

Reports and routines associated with the Bank Reconciliation system include the following:

• Journal Entries

• Outstanding Cheque Listing

• Outstanding Deposits Listing

• Returned Cheque Entry

• Deposits Cleared Entry

• Bank Reconciliation Report

The Bank Reconciliation system allows the Firm to effectively track Cheque and Deposit transactions, ensuring up to date and accurate Bank Account balances and information. The Bank Reconciliation system also allows the Firm to easily identify and correct any discrepancies between Bank Statements and in-house accounting statements.

Features

• Point and click returned cheque entry and deposits cleared

• Ability to reprint outstanding cheques/deposits reports

• Fast and easy Bank Reconciliation

Billing and Accounts Receivable

The Billing and Accounts Receivable routines are fully integrated with all other aspects of accounting. Therefore, the Matter Status Inquiry and the Billing Statement present a snapshot of the Client's Matter, including Accounts Receivable, Trust, Disbursements, and Unbilled Time.

Lighthouse provides the user with an efficient and easy to use billings process. The Bill Printing routine allows the user to generate professional bills without using a word processor. However, export routines are available for importing billing information to MS Word or WordPerfect. Narrative maintenance, time adjustments, and disbursement adjustments may be accessed directly from the billing area. The information from the Billing Draft is automatically transferred to the Billing Entry screen. All printed bills are stored in a Matter specific folder, available for review at any time.

Management can set billing 'rules'. Should a lawyer be able to over-bill disbursements on a final bill? Are revenue postings or fees posted to the General Ledger by department based on the Billing Lawyer, the Fee Credit Lawyer, or a standard revenue account? Should the fee credits be calculated automatically or should they be manually entered? These are some of the options that may be defined with the click of a button.

Receivable reports may be printed off by Client Lawyer, Responsible Lawyer, or by Billing Lawyer. A great feature on these reports is that the Client contact and phone number are printed so that collection calls, if necessary, can be easily made. Trust Balances are also printed so lawyers can quickly see if a transfer from trust should be made to pay an account.

Receivable reminders may be printed by Client or by Matter. A unique feature of the Matter Statement is that it allows for printing reminders every day of the month – identifying only those Matters that have unpaid accounts over a user specified number of days. This reduces the traditional pile of reminders that managers or lawyers need to review to a more manageable number.

Features

• Matter Status Inquiry with drill down for details

• Flexible pre-billing and client history reports

• Bill printing and export to word processing applications

• User defined bill formats

• Electronic Billing formats available

• Optional automatic email of PDF bills

General Ledger and Financial Statements

Central to the legal accounting system is the general ledger. The Chart of Accounts is easily established and maintained. Managers can determine if an account may be accessed via disbursement entry, cash receipts, General Ledger Journal entries, or via any combination of such entries. This feature greatly reduces the chance of accounts being posted in the wrong routines.

Standard with the application are Balance Sheet, Income Statement, Operating Statements, and Trial Balances. User setup is not required.

When postings are made to the General Ledger, detailed audit trails provide accurate information based on the source of the entries. All transactions in the system are given a unique identifier, allowing users to track down each and every entry, quickly and easily.

General Ledger Detailed Schedules may be printed identifying all transactions to a particular account in detail. They provide an easy method of reconciling and controlling Expense Accounts, Lawyers Promotion Accounts, and Drawings Accounts.

Lighthouse addresses the need for uncomplicated budget entry. Budget amounts can be straight-lined over the fiscal period with simply the click of a mouse, or they may be distributed as dollar figures or percentage amounts.

Lighthouse allows the user to perform manual journal entries for transactions that occur outside of normal processing. General Ledger Journal Entries can be backdated, therefore allowing month end adjustment entries to be made after month end Processing. Frequently posted Repetitive Entries may be defined once, reducing the effort to make standard entries on a regular basis. Accrual Entries need only have the first transaction posted, the accrual will be automatically posted when the user accesses the Journal Entry routine in the new period.

All reports may be sent to spreadsheet for increased flexibility when analyzing data.

Features

• Operating Statement, Income Statement, and Balance Sheet

• Automatic Sub-ledger posting

• Detailed Schedules

• Easy to setup Chart of Account

• Budgets

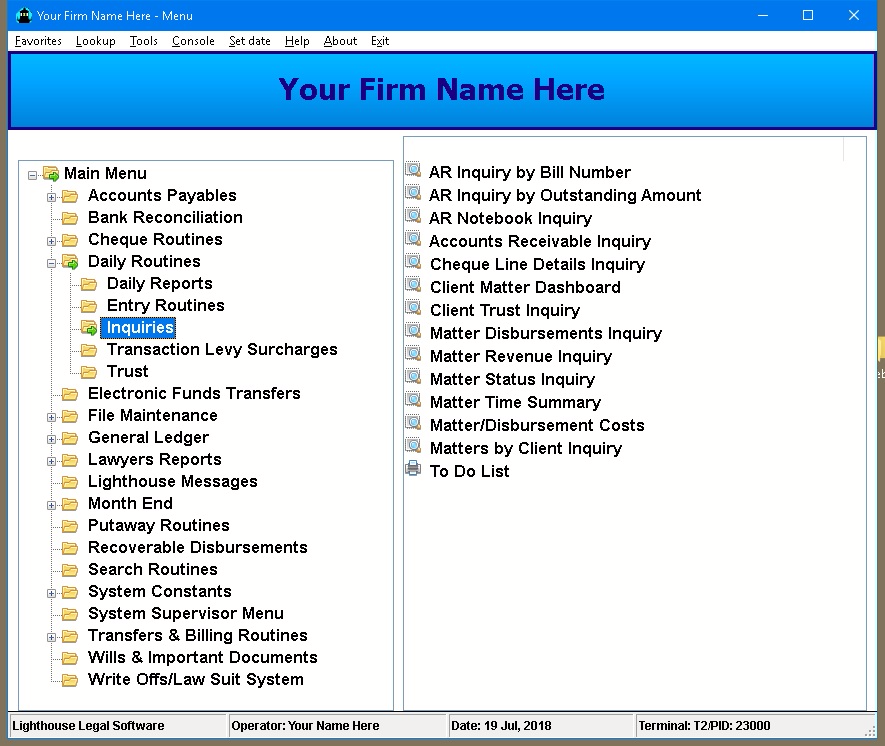

Management Reporting

One of the main benefits of Lighthouse is the management reporting available. Have you ever asked questions like:

• Which files are carrying high amounts of unbilled WIP and disbursements?

• Which files have not been worked on for a given time period?

• How much time, in hours and dollars, has a lawyer posted in the current year? In the previous year?

• How many more billable hours are required for a lawyer to meet their budget amount?

• Is a lawyer quickly approaching the amount of the fee quoted to the client with the value of unbilled time on file and fees billed?

• What is the accounts receivable balance for all matters that a large client may have? Has a retainer been taken on any of those matters?

Using the wide range of Management Reports available, Administrators can identify these potential problems and provide answers to these questions quickly and easily.

Want to know what the report looks like? Using the Online Help, the user can view a snapshot of the report format and the details it includes.

All reports can be viewed on the screen - allowing users to do their part to save the environment, as well as saving Firm time and money.

Although third party products are available to generate reports, most users choose to have custom reports developed to address their specific needs. Contact us directly, or send a request via the Wish List to our development department if you need something new.

Features

• Wide variety of standard reports

• Send to screen, spreadsheet or printer

• Security settings give administrators control over who sees what

Matters and Clients

Creating new Matters and Clients is fast and easy. Matter numbers and Client codes may be system generated or user entered. If an operator is attempting to post a transaction to a new Matter and the Matter has not yet been setup, a press of a button will take them directly to Matter/Client Maintenance (if security access rights have been given to the operator). This feature reduces the amount of time spent posting transactions.

One powerful feature of the Client Maintenance routine is the link to the Conflict System. If a new Client is about to be entered, the system allows the operator to do a conflict search before the Client is setup. This feature will reduce the possibility of conflicts and will also alert the operator if the Client already exists in the system.

Clients and Matters may be defined to have lawyer-specific rates based on an actual dollar amount or a percentage of the lawyer's standard fee. If the rate/percentage applies to all lawyers in the firm, a click of a button is all that is required.

Want to mail letters to new Clients, welcoming them to your firm? Using the mail merge features of Lighthouse, this task is completed with ease. Lighthouse has routines that allow the operator to transfer the data of new Clients and Matters to your word processing application. Build letters, labels, or invitations using the data found in your accounting database.

Another time saving feature of Lighthouse is the Name Search, which is associated with all entry routines. If an operator cannot remember a Matter number or Client code, but does know part of the Client name or part of the Matter name (or both), the Name Search will display all matches to their search and will then transfer the applicable data to the entry screen. Additionally, a Name Search performed outside of a data entry routine will copy all Client and Matter address information to the Windows Clipboard for pasting to another application.

Features

• Client 'Idendification documents' retrieval

• User defined fields based on law categories

• 'Soundex' Conflict System checking

• Contact information database

• Third party billing

• Pending Matters/Clients database

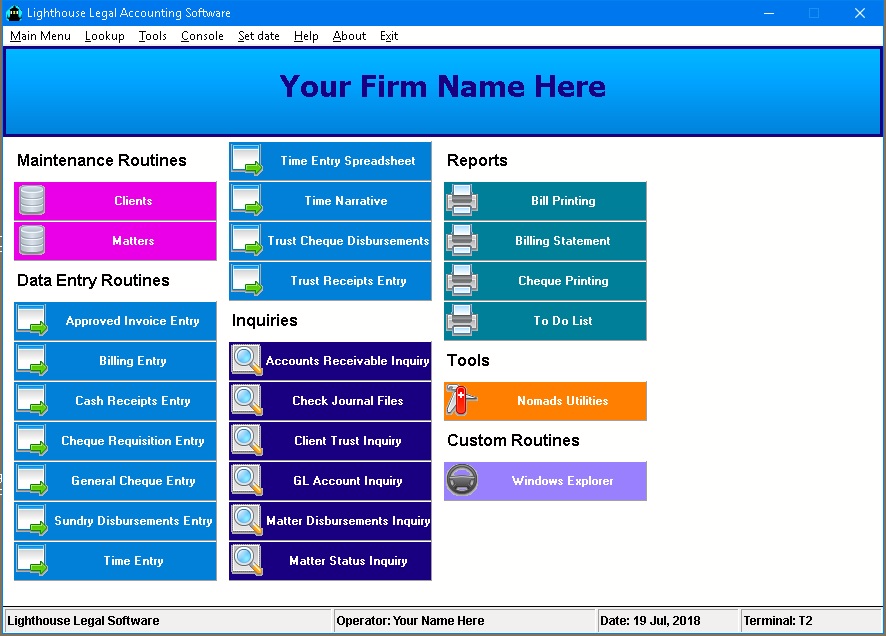

Transaction Processing

Posting of transactions in Lighthouse is simple and intuitive. Entry screens are easy to read and understand - users spend less time learning how to use Lighthouse and more time using it. Each transaction is assigned a unique transaction number - this makes tracking down entries a very simple process.

Postings that affect the General Ledger are completely integrated. There's no need to post transactions to matters and then post Journal Entries to the General Ledger. Lighthouse does it all, simply and easily.

Input screens have queries, name lookups, and related inquiry routines available with the click of a button. Screen formats have been designed for maximum speed of data entry - an important consideration in a busy practice.

Let us show you how using Lighthouse can streamline your office procedures.

Reports and routines associated with Transaction Processing include the following:

• Electronic Cheque Requisitions

• General Cheques

• Trust Cheques

• Cash Receipts

• Trust Receipts

• Petty Cash

• Sundry Disbursements

• Time Entry

• Recoverable Disbursements import from third party applications

Features

• Easy to understand input screens

• All transactions assigned unique journal based audit number

• Journal updates automatically saved for review purposes

Trust Accounting

Lighthouse features Trust Accounting that fully adheres to Law Society regulations. Trust Accounting is fully integrated with all other accounting functions. As trust monies are received and disbursed, the entire system is updated with the information. The Trust Transaction Register, an on-demand report allows management to review all trust transactions for any period.

Reports and routines associated with Trust Accounting include the following:

• Client Trust Inquiry

• Client Trust Statement

• Trust Cheque Journal

• Trust Receipts Journal

• Trust Transfers Journal

• Client Trust Listing

Features

• Ability to prevent Trust Transactions if Client ID not on file

• User defined receipt types

• Enter International status on receipt entry

• Prevent posting of cheques until receipt has cleared bank